Real-World Applications of Programmable Oracles

This module examines how programmable oracles are applied in practice across industries. It highlights their central role in decentralized finance, their use in dynamic NFTs and gaming, and their importance in parametric insurance, supply chains, and cross-chain interoperability. By linking blockchains with external events, oracles enable automation of financial contracts, enterprise processes, and tokenized real-world assets.

The centrality of oracles in decentralized finance

Decentralized finance, often referred to as DeFi, has become the sector where oracles have had the greatest impact. At the core of many protocols is the need for accurate and timely price data. Lending platforms such as those that allow collateralized borrowing depend on asset valuations to determine when a position should be liquidated. If the price feed is manipulated or delayed, the integrity of the protocol is immediately at risk.

Programmable oracle networks enable price aggregation from multiple venues, apply filters to reduce the influence of outliers, and deliver data on-chain with minimal delay. Beyond prices, programmable oracles also compute reference rates, volatility indices, and synthetic benchmarks, which are necessary for derivatives, stablecoins, and automated portfolio strategies. In this way, oracles have become indispensable in maintaining both the functionality and the security of the DeFi ecosystem.

Dynamic non-fungible tokens and gaming ecosystems

In the world of non-fungible tokens and blockchain gaming, programmability at the oracle layer opens up new possibilities. Traditional NFTs are static representations of ownership, but when linked with external data they become dynamic and interactive.

A digital collectible can change its appearance based on real-time sporting results, weather conditions, or the performance of an underlying asset. In gaming, randomness is critical for fair outcomes in lotteries, loot drops, or competitive tournaments.

Programmable oracles provide verifiable random values that players and developers can independently check, removing the risk of behind-the-scenes manipulation. They also allow off-chain game mechanics to influence on-chain assets, such as updating character attributes or triggering storyline events. This integration transforms NFTs from static artifacts into living digital objects whose characteristics respond to external conditions in verifiable ways.

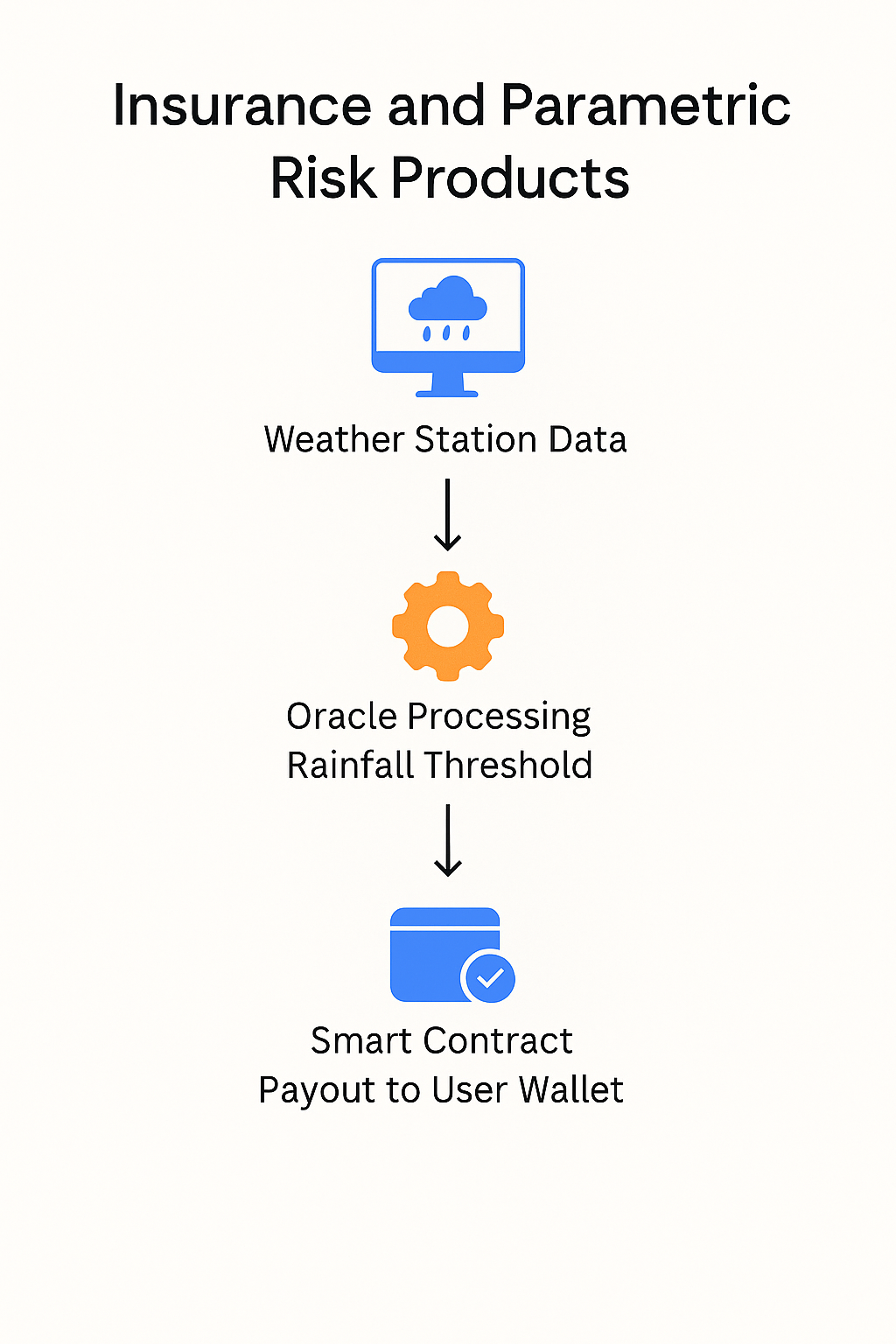

Insurance and parametric risk products

Insurance represents another area where programmable oracles deliver practical utility. Traditional insurance products depend on lengthy claims processes that involve manual verification and subjective judgment. By contrast, parametric insurance relies on objective conditions being met, such as rainfall below a threshold, temperature exceeding a certain level, or flight delays lasting more than a specified period.

Programmable oracle networks fetch the required data from multiple sources, validate it, and compute whether the conditions for payout are satisfied. Once verified, the result is transmitted to the contract, which automatically executes the settlement. This approach reduces administrative overhead, increases transparency for policyholders, and allows for micro-insurance products that are uneconomical under traditional models.

The programmability of oracles ensures that contracts can incorporate complex conditions, such as combining multiple variables or applying exclusion rules, without requiring heavy computation on the blockchain itself.

Supply chains, trade finance, and the internet of things

Programmable oracles are also reshaping how blockchains interact with physical supply chains. Many industries rely on real-time tracking of goods, compliance with environmental standards, or confirmation of delivery milestones. IoT devices such as GPS trackers, temperature sensors, and radio-frequency scanners produce streams of data that can be captured by oracle networks. By filtering, validating, and aggregating this information, programmable oracles allow smart contracts to execute business logic automatically.

For example, a trade finance contract could release funds once goods pass through a customs checkpoint and temperature sensors confirm storage requirements were met. Similarly, compliance frameworks in agriculture or pharmaceuticals can use oracle data to ensure that products are transported under regulated conditions. This application reduces reliance on manual auditing while maintaining verifiable digital records tied directly to on-chain agreements.

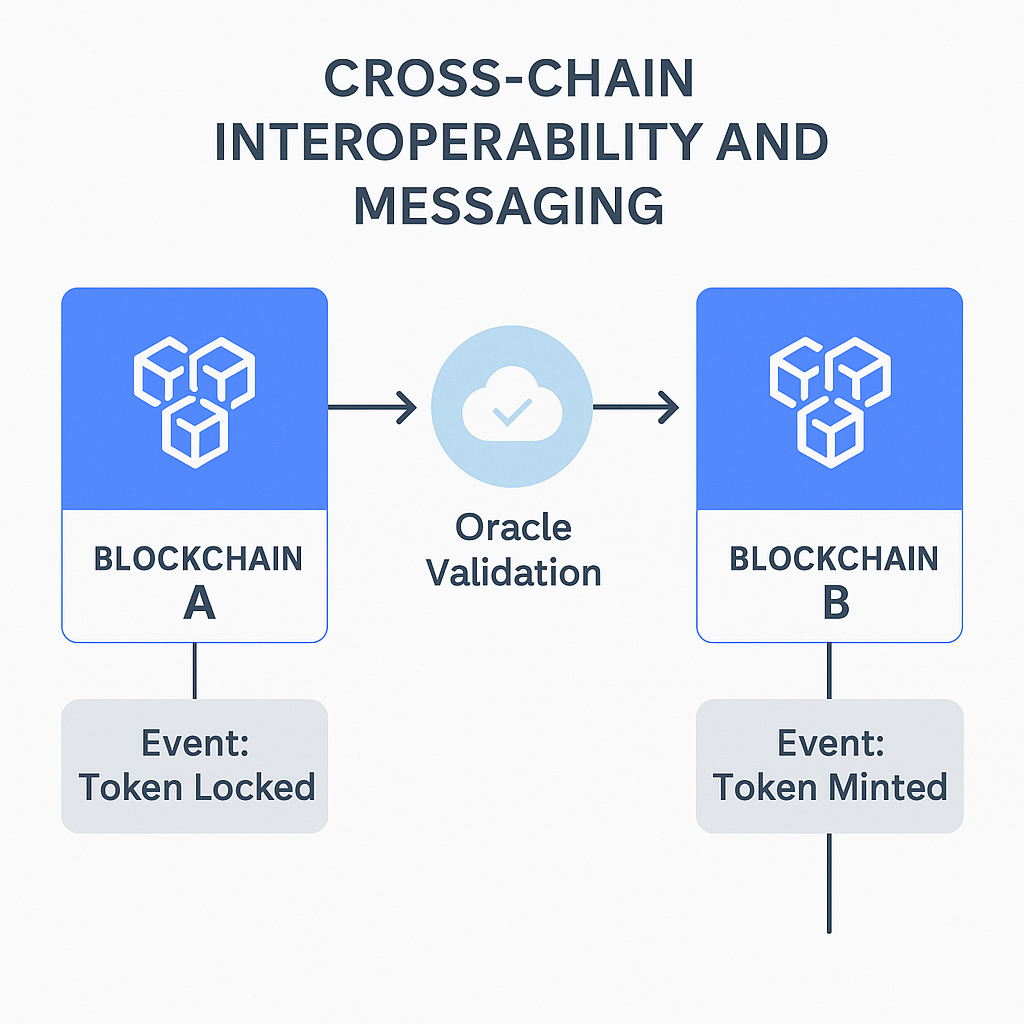

Cross-chain interoperability and messaging

As the blockchain ecosystem fragments into specialized networks, interoperability becomes an essential feature. Programmable oracle networks play a central role by providing verifiable communication between chains. They can confirm the state of an account on one blockchain and relay it to another, enabling cross-chain transfers, asset wrapping, and unified liquidity pools. This function requires not just data transmission but also computation to verify consensus proofs, reconcile different block structures, and apply logic about finality thresholds.

Programmable oracles thus act as a secure bridge, ensuring that information carried between chains maintains its integrity and cannot be forged by an intermediary. By enabling interoperability, oracle networks expand the design space for decentralized applications, allowing them to span multiple ecosystems while maintaining security guarantees.

Real-world assets and tokenization

Tokenization of real-world assets depends heavily on reliable data feeds. Assets such as bonds, commodities, or real estate require regular updates about their valuation, performance, or legal status. Programmable oracles provide the infrastructure to fetch these updates from regulated institutions, rating agencies, or government records.

For example, a tokenized bond can automatically update its yield distribution according to interest rate changes published by official sources. A commodity-backed stablecoin can adjust its collateralization ratios based on global spot prices.

By embedding programmable logic, oracle networks can ensure that tokenized assets remain synchronized with their real-world counterparts. This capability underpins the broader ambition of bringing traditional financial instruments into the blockchain environment in a trustworthy and compliant way.

Enterprise applications and regulatory compliance

Beyond finance, programmable oracles support enterprise applications that depend on trusted data exchange. Corporations managing supply contracts, royalty payments, or compliance obligations can use oracle networks to verify milestones objectively.

For instance, energy companies may rely on certified emissions data delivered via oracles to trigger carbon credit settlements. Pharmaceutical firms can integrate regulatory data about drug approvals or recalls to automate inventory management and sales restrictions. These applications highlight that programmable oracles are not limited to consumer-facing products but also serve as infrastructure for enterprise workflows where compliance, auditability, and transparency are non-negotiable.

The broader implications of programmability

The applications of programmable oracles illustrate a consistent theme: they extend the scope of what blockchains can achieve by embedding real-world logic into decentralized systems. Whether in DeFi, NFTs, insurance, supply chains, or cross-chain messaging, oracles ensure that contracts are not isolated from the environments in which they operate.

Programmability ensures that inputs are not raw and context-free but processed according to predefined logic that mirrors contractual or regulatory requirements. This development moves blockchain systems closer to being autonomous infrastructures capable of integrating seamlessly with economic and social processes. As adoption increases, programmable oracles are likely to become foundational components of decentralized applications, shaping both their functionality and their reliability in practice.