Leading Architectures, Providers, and the Current Landscape

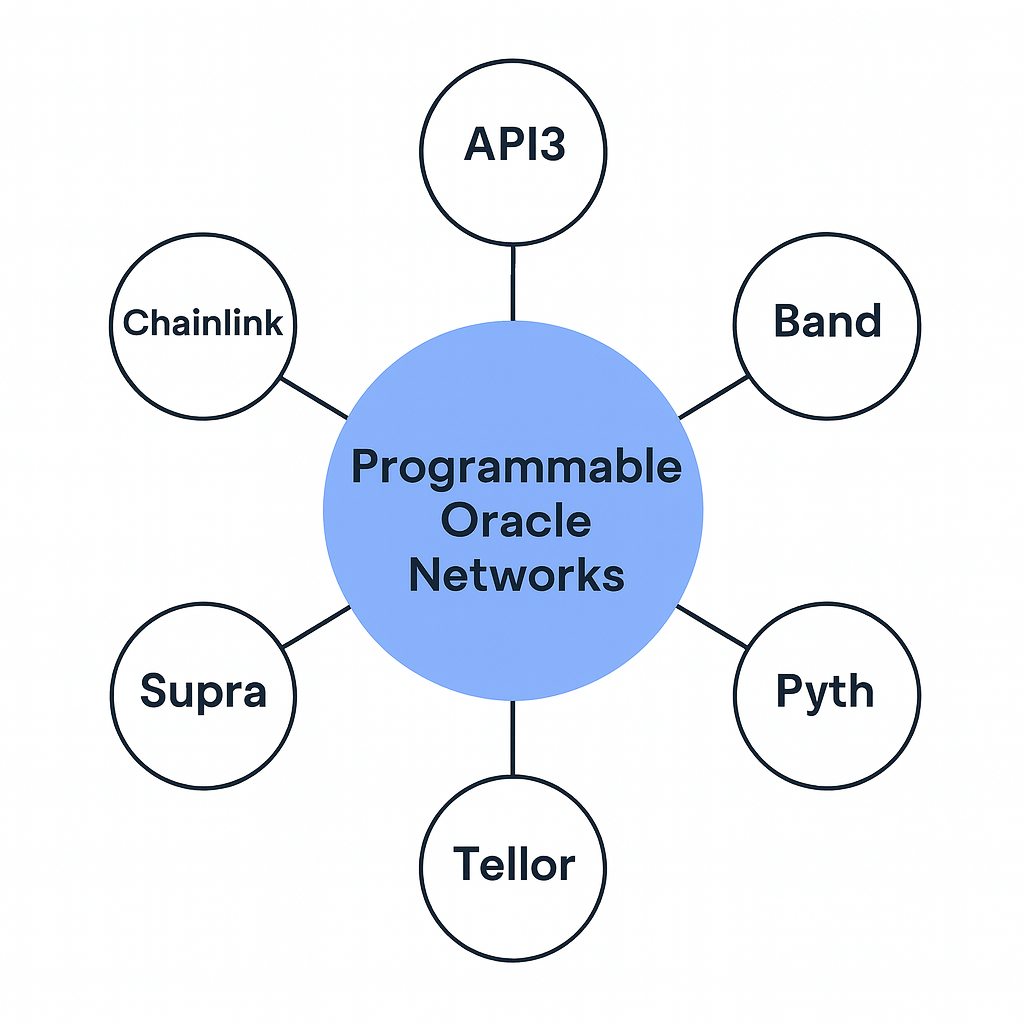

This module surveys the current ecosystem of oracle providers, including Chainlink, API3, Band Protocol, Pyth, and emerging players like Supra and Tellor. It compares their architectures, governance models, and specializations while addressing scalability, cost, and regulatory concerns. Learners will gain perspective on the diversity of oracle networks and the converging principles shaping the sector’s future.

The emergence of decentralized oracle ecosystems

The rise of programmable oracle networks has been closely linked to the emergence of specialized providers that build infrastructure for data reliability, computation, and interoperability. These providers differ in architecture, governance, and scope of services, but collectively they form the backbone of how decentralized applications interact with external environments.

The diversity of approaches reflects not only technical choices but also philosophical differences regarding decentralization, efficiency, and developer accessibility. Understanding the leading providers and their architectures offers insight into the direction of the oracle sector and its role in shaping Web3.

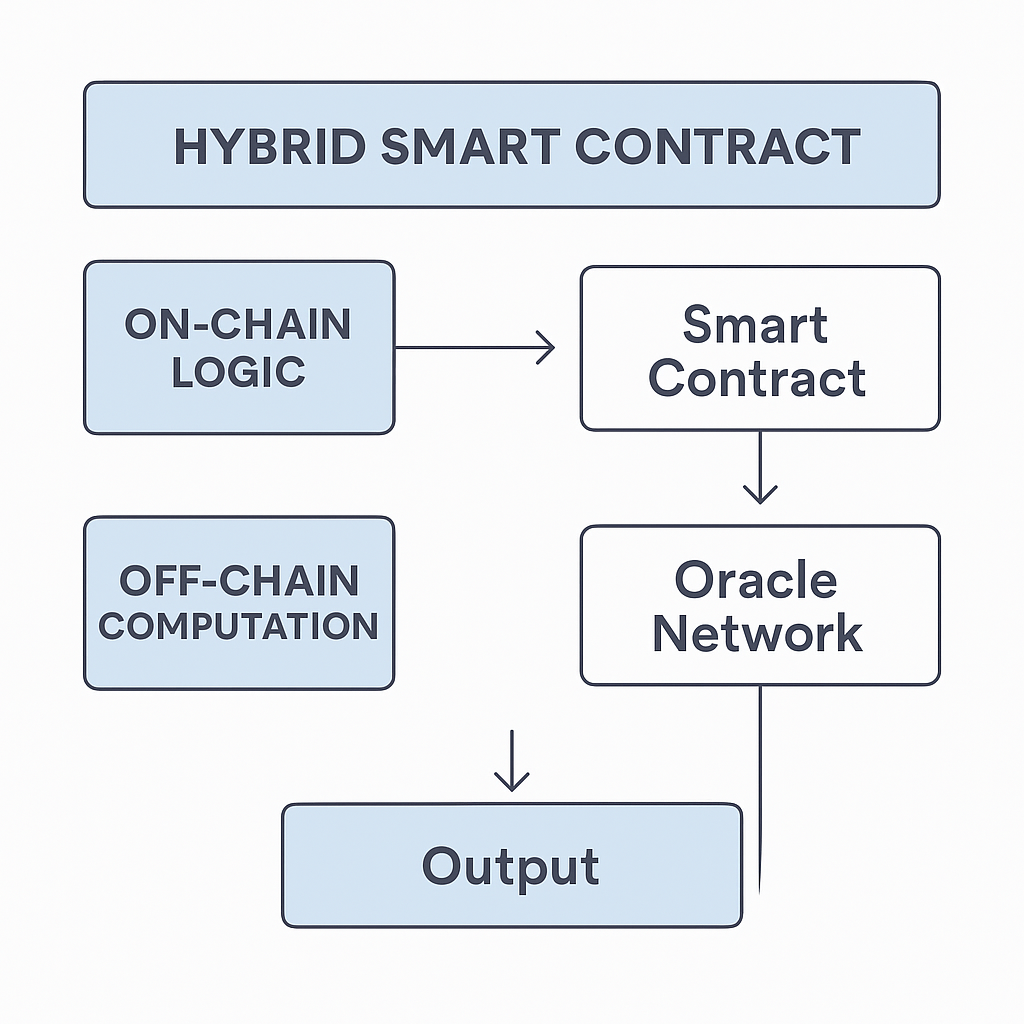

Chainlink and the model of hybrid smart contracts

Chainlink remains the most widely adopted oracle network in decentralized finance and beyond. Its architecture is built around a decentralized network of node operators that deliver data feeds to smart contracts. Chainlink popularized the concept of decentralized price oracles, where independent nodes source data from multiple markets, aggregate it, and provide a tamper-resistant value.

Over time, the system expanded into specialized services such as verifiable randomness functions, proof of reserves, and external adapter frameworks. More recently, Chainlink introduced cross-chain interoperability protocols, positioning itself not just as a data network but also as a messaging layer connecting different blockchains.

Its concept of hybrid smart contracts reflects a vision where on-chain logic is combined with off-chain computation performed by oracle networks. This model has influenced how developers think about extending blockchain functionality while maintaining trust minimization.

API3 and the direct data feed approach

Another prominent provider is API3, which distinguishes itself by focusing on first-party oracles. Instead of relying on independent node operators to source and deliver data, API3 enables data providers themselves to run oracle nodes. This architecture is designed to reduce the number of intermediaries, lowering costs and minimizing opportunities for tampering.

By letting the original data source control the oracle feed, API3 emphasizes authenticity and accountability. The network is governed through a decentralized autonomous organization, allowing stakeholders to vote on parameters, upgrades, and incentive structures. While this model differs from Chainlink’s multi-operator aggregation approach, both systems reflect trade-offs between decentralization, efficiency, and trust.

Band Protocol and cross-chain integration

Band Protocol offers another perspective on oracle architecture, leveraging its own blockchain built on the Cosmos SDK to deliver data across chains. By maintaining a dedicated network optimized for oracle operations, Band reduces latency and provides flexible query mechanisms.

The protocol supports cross-chain communication through the Inter-Blockchain Communication protocol, allowing it to serve data to multiple chains within the Cosmos ecosystem and beyond. This design highlights how oracle networks are not limited to Ethereum-based systems but can operate as sovereign chains with their own consensus and security models. Band’s approach demonstrates the trend of treating oracles as infrastructure-level projects that integrate deeply with multi-chain ecosystems.

Pyth and the publisher-based model

Pyth Network introduces a different mechanism centered on direct data publishing by market participants. Exchanges, trading firms, and financial institutions act as data publishers, streaming real-time information directly to the oracle network. The system aggregates these inputs and produces consolidated feeds that decentralized applications can consume.

This architecture is particularly suited to high-frequency data such as asset prices, where latency and accuracy are critical. By involving primary market actors as data publishers, Pyth reduces dependency on secondary data collection and enhances the credibility of the feeds. Its adoption across multiple blockchains underscores the demand for low-latency, high-integrity data in both DeFi and traditional financial integrations.

Supra, Tellor, and other emerging networks

Beyond the largest players, several emerging oracle projects are experimenting with novel designs.

Supra focuses on cross-chain interoperability and fast finality, aiming to support decentralized applications that require near real-time updates. Tellor emphasizes permissionless participation, where anyone can act as a data reporter and disputes are resolved through staking-based mechanisms. These models broaden the landscape of oracles by exploring different balances between openness, security, and speed. The proliferation of providers indicates that no single architecture dominates the field entirely, and multiple designs are likely to coexist, each optimized for specific categories of applications.

Security, governance, and accountability

The current landscape of oracle networks is shaped as much by governance choices as by technical ones. Some networks rely on decentralized autonomous organizations to manage parameters, upgrade paths, and treasury allocations. Others maintain core development teams with significant influence over protocol evolution.

Accountability mechanisms vary as well, from staking-based slashing for dishonest behavior to reputation systems and third-party audits. The differences highlight an ongoing tension between decentralization and operational efficiency. While greater decentralization reduces reliance on any single authority, it can slow decision-making and complicate upgrades. Conversely, streamlined governance can accelerate innovation but risks introducing points of centralization.

Regulatory considerations and institutional engagement

As programmable oracle networks become integrated with tokenized real-world assets and regulated financial products, questions of compliance and legal recognition grow in importance. Networks that deliver price feeds for securities or settlement data for bonds must ensure that their processes meet regulatory expectations around accuracy, transparency, and auditability. Some providers have begun to partner with traditional financial institutions, offering proof of reserves or compliance-oriented feeds that align with existing legal frameworks.

The increasing involvement of major asset managers and exchanges as data publishers indicates that oracle networks are moving beyond experimental stages and into regulated financial markets. This trend also raises the stakes for reliability and accountability, as errors could have implications not only for decentralized applications but also for compliance with financial regulations.

The challenges of scalability and cost

Despite their progress, oracle networks face challenges related to scalability and cost. Delivering high-frequency data on-chain remains expensive due to gas fees and network congestion. Some providers mitigate this by updating feeds only when values deviate significantly, while others explore layer-two solutions or off-chain aggregation methods to reduce on-chain load.

The design of incentive systems must also account for sustainability: operators and data publishers require fair compensation, but users expect affordable fees. Balancing these concerns remains an active area of experimentation and refinement across different providers.

A fragmented but converging landscape

The landscape of programmable oracle networks today is diverse, with providers adopting different architectures, governance models, and areas of specialization. Yet, there is also a convergence around certain principles. Decentralization is viewed as essential for security, programmability is recognized as a way to expand utility, and cross-chain interoperability is increasingly a requirement in a multi-chain world.

The coexistence of different models demonstrates that oracle networks are not a one-size-fits-all solution but a set of evolving infrastructures that will continue to adapt to new demands. Together, they form the connective tissue that allows blockchains to engage with real-world data, other ledgers, and complex external systems in ways that uphold the security and transparency central to decentralized technology.