RIF Token – Bitcoin’s Utility Powerhouse Unleashed

Ever heard of RIF? If not, you’re not alone – but crypto die-hards are buzzing about this under-the-radar token bringing Bitcoin into the DeFi arena. RIF stands for RSK Infrastructure Framework, and it’s all about adding superpowers to Bitcoin’s ecosystem. In this fun deep dive, we’ll explore RIF’s utility and ecosystem, check out what the community on X (formerly Twitter) is saying, and dig into price predictions (short-term and long-term) with some charts. Let’s jump in! 🎉

Overview: What the RIF Token Does and Why It Matters 🌐

RIF is like the Swiss Army knife of Bitcoin’s layer-2. It’s built on Rootstock (RSK) – a smart contract sidechain pegged to Bitcoin – meaning RIF gets Bitcoin’s security but with Ethereum-like flexibility. The RIF token is the utility token fueling a whole suite of decentralized services in the RSK ecosystem. Holding RIF gives you access to all these services (and you use RIF to pay fees for them). In a nutshell, RIF is trying to create an “Internet of Value” on Bitcoin. Here are the key pieces of the RIF ecosystem that make it a utility powerhouse:

- RIF Name Service (RNS): Replaces clunky blockchain addresses with human-readable names (like an email for your crypto wallet – e.g. alice.rsk). This makes crypto more user-friendly.

- RIF Payments (Lumino): An off-chain payment network (similar to Lightning ⚡) that enables fast, low-fee transactions on RSK. Great for micro-payments or everyday crypto use without waiting on slow blocks.

- RIF Storage: A decentralized storage marketplace. Think of it like a crypto Dropbox – users pay RIF tokens to store files across many nodes, and storage providers earn RIF for contributing space. Censorship-resistant and no single point of failure.

- RIF Communications: Encrypted P2P messaging and notifications for dApps. Developers can integrate RIF’s messaging so users chat and get alerts without centralized servers (privacy for the win!).

- RIF Gateways (Oracles & Bridges): Allows RSK smart contracts to interact with the outside world. Price feeds, weather data, you name it – RIF Gateways pulls it in securely. It also includes cross-chain bridges (e.g. faster ways to move Bitcoin in/out of RSK).

All these services share one token – RIF – which simplifies things. Instead of juggling separate tokens for each service, you just use RIF for everything (paying for a domain name, renting storage, etc.). This one-token-for-all model creates a circular economy: as more people use any RIF service, demand for the RIF token grows, rewarding those who provide services. RIF even has a say in governance now; holders can participate in the Rootstock Collective (a community DAO) to vote on proposals and steer the project’s future. Overall, RIF’s utility is all about making Bitcoin-based DeFi and Web3 possible – identity, payments, storage, data services – all under one roof. For traders on Gate.io and beyond, that means RIF isn’t just another meme coin; it’s a “picks and shovels” play on the Bitcoin ecosystem. 🛠️

The Buzz on X (Twitter): Community Hype, Influencers & Dev Updates 💬

RIF might be quietly building, but on Crypto Twitter (X) it’s starting to make noise! Here’s what’s trending in the RIF community lately:

Influencers Feeling Bullish: Several crypto influencers on X have called RIF “massively undervalued.” They’re hyping its role as “Bitcoin’s DeFi layer”, noting that RIF’s market cap (around ~$50–$60M) is tiny compared to its potential. Posts by enthusiasts often highlight RIF enabling Bitcoin-native smart contracts, identity, and DeFi – a big narrative as Bitcoin’s ecosystem expands. It’s not uncommon to see tweets saying “Don’t regret missing the ride when it takes off” – 🚀 accompanied by hashtags like #RIF and #Rootstock. The vibe is that RIF is a sleeper gem that could take off if the broader market notices.

Community Sentiment & Hashtags: The community sentiment on X skews positive and excited. Loyal RSK/RIF followers use hashtags like #BitcoinDeFi and #Rootstock alongside #RIF, framing it as part of Bitcoin’s next evolution. There’s chatter about RIF’s low price being an opportunity, with users sharing charts and technical analysis. For example, some pointed out recently that on the weekly chart, RIF’s technical indicators flipped bullish (with all major moving averages indicating a buy). Seeing a small-cap token flash strong buy signals has folks tweeting up a storm, comparing the current setup to previous takeoff points. In short, the community thinks RIF is on the cusp of something big (and they’re not shy about memeing a rocket or two 😜).

Developer Updates & Official News: The team behind RIF (IOV Labs and the RSK devs) has been active in shipping updates – and the official account @rif_os shares these regularly. Recent buzzworthy developments include a new liquidity staking feature (allowing RIF holders to stake tokens and earn rewards while supporting the network) and partnerships to strengthen the tech. For instance, RIF partnered with Swarm (a decentralized storage project) to turbo-charge RIF Storage, and they’ve integrated Chainlink oracles into RIF Gateways to improve off-chain data reliability. The community loves these updates – they show that RIF is not a ghost chain; it’s growing and improving. Even big exchanges have taken note: last year Binance supported a RIF network upgrade that improved scalability and security on Rootstock. Developer updates often come with hashtags like #RIFGateways or #RNS, and they reinforce confidence that the project is alive and kicking.

In summary, crypto Twitter’s take is a mix of “RIF is the future of Bitcoin DeFi!” and “Keep building, we’re watching.” The hype is there, but grounded in real progress.

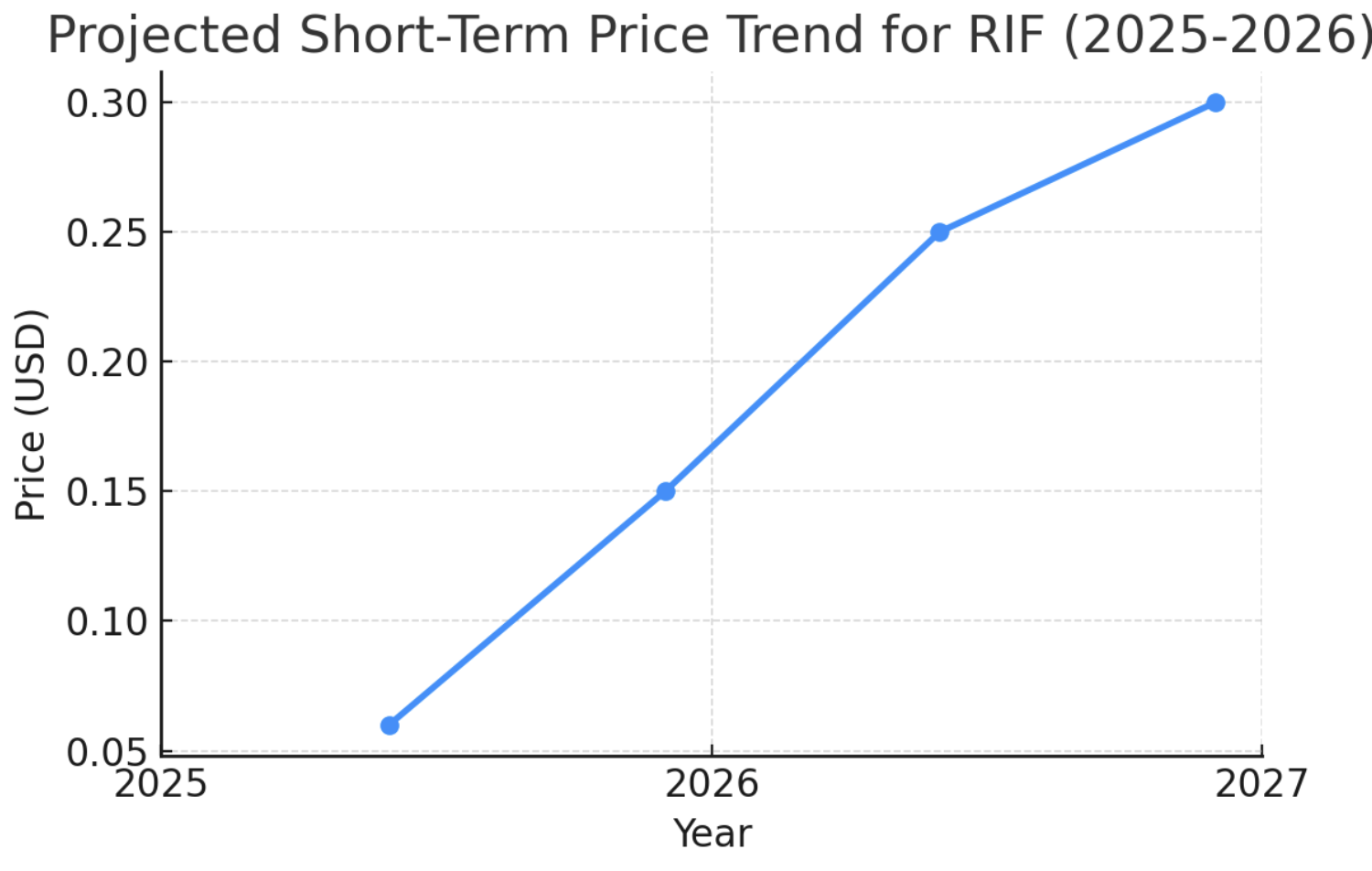

Short-Term Price Outlook (2025–2026) 📈

Let’s talk numbers! What might RIF be worth in the next year or two? Short-term predictions always come with a huge grain of salt, but it’s fun to speculate – especially with RIF’s buzz on social media. The period of 2025–2026 will likely be influenced by the broader crypto cycle and RIF’s own milestones:

Bullish Scenario: Many analysts expect Bitcoin’s next halving (in 2024) to spark a bull run in 2025. If that holds true, 2025 could be a breakout year for tokens in Bitcoin’s ecosystem like RIF. In a optimistic case, RIF might ride that wave and also get a boost from its growing utility. A conservative bet for 2025 is RIF clawing back to around $0.10 (roughly double the current price) – basically recovering a bit of its previous highs. But more bullish community forecasts put RIF in the $0.20–$0.30 range by late 2025. 🥳 That would mean RIF returns to prices not seen since the 2021 hype cycle, reflecting real traction. Some ultra-bullish crypto models even spit out targets up to ~$0.50 for end of 2025 (which would be a 10x from today!). While $0.50 sounds far-fetched, in crypto land stranger things have happened – especially if RIF suddenly catches fire with a major dApp or a big exchange listing. By 2026, if the Bitcoin bull run extends, RIF could potentially push toward that $0.30–$0.50 zone on strong momentum. This assumes that by 2026, RSK has significantly more users, perhaps thousands of RNS domains registered and multiple popular apps driving demand for RIF.

Bearish/Base Case: Of course, it’s not guaranteed that 2025 will be all sunshine. If the crypto market underperforms (say, regulatory FUD or a lukewarm post-halving response), RIF’s price could stay muted. In a bearish scenario, RIF might just hover around where it is now, in the $0.03–$0.06 range through 2025, only ticking up gradually. This could happen if RSK dApps don’t gain users or if larger competitors overshadow RIF’s services. By 2026, even in a base-case scenario, most traders expect some growth from current levels – perhaps RIF in the low teens of cents ($0.10-ish) as a reflection of steady, if not explosive, progress. Essentially, downside feels relatively limited at these depressed prices, but crypto markets can always surprise.

In summary, the short-term outlook for RIF (2025–2026) skews cautiously optimistic. The community sentiment and on-chain progress suggest upside potential, especially if a crypto bull cycle kicks in. A doubling or tripling of price isn’t unrealistic if things go well – but remember that RIF’s real moon mission depends on actual adoption of its tech, not just Twitter hype. 🚀 Keep an eye on Bitcoin’s trajectory and RIF’s development updates; those will be key in determining which path RIF takes in the next two years.

Long-Term Price Outlook (2027–2028) 🔮

Looking further out, predictions get even hazier – but let’s imagine where RIF could be by 2027–2028. By this time, the initial hype will need to be backed by real adoption. Here are some possibilities for RIF’s longer-term future:

Growth Scenario (Utility Wins): Fast forward to 2028 – suppose RIF has helped Bitcoin DeFi really blossom. Maybe Rootstock has cemented itself as a key layer-2, with RIF providing services to a thriving ecosystem of dApps used by millions. In this scenario, RIF’s price could reflect dramatically higher demand. Breaking past its old all-time high (~$0.50 from 2021) is on the table. Some community long-term bets see RIF aiming for $0.50+ by 2027, and if the stars align, possibly approaching $1 by 2028. 😮 For that kind of valuation (nearly 15-20x from current levels), RIF would need to achieve something monumental: perhaps becoming as indispensable in the Bitcoin world as, say, Chainlink is for oracles or Filecoin for storage in the wider crypto world. It’s a tall order, but if Bitcoin’s next cycles bring more attention to decentralized infrastructure, RIF is positioned to ride that wave. Another catalyst: the 2028 Bitcoin halving – it could spark renewed interest in Bitcoin-layer projects, giving RIF another boost heading into that year. Long-term optimists argue that by 2028, RIF’s value will be more fundamentally supported – meaning even during market dips it could hold strong because people need RIF tokens to use critical services (like a true utility token should).

Moderate or Bear Case (Competition or Niche Status): On the flip side, what if RIF grows, but only modestly? It’s possible that RSK and RIF remain somewhat niche – maybe they gain a loyal user base but don’t explode into the mainstream DeFi scene. Also, competitors could steal the thunder: for example, Ethereum-based solutions (like ENS for naming or Filecoin/Arweave for storage) might dominate, or other Bitcoin layer-2 projects (like Stacks with its STX token) might overshadow RIF in usage. In such a case, RIF might still appreciate, but not skyrocket. By 2027–2028, it might trade in a comfortable range (say $0.10–$0.20) if adoption is only lukewarm. This would reflect growth from today but not a full breakout. Additionally, the natural crypto market rhythm could play a role: if 2025 ends up a huge bull year, 2026–2027 might be quieter or bearish (historical cycle trends). Even a fundamentally solid project like RIF could see its price stall or dip in a broad market cooldown. So a scenario exists where RIF in 2027 is not far from its 2025 levels, if the hype cycles ebb.

In essence, by 2028 the hope is that RIF’s price is driven less by hype and more by real utility. The best-case outlook has RIF becoming a cornerstone of Bitcoin’s decentralized economy – which would likely be reflected in a much higher price (potentially new highs). The cautious outlook has RIF growing slowly, more in line with actual network usage. For long-term holders, the key metric to watch won’t just be the price chart, but metrics like how many people are using RIF services (domains registered, GB of data stored, etc.). Those will tell the story of whether RIF can truly fulfill its promise by 2028. 📊

How Does RIF Compare? 🚦 RIF vs. Similar Tokens

In the crowded crypto landscape, how does RIF stack up against similar utility tokens and infrastructure projects? Here are a few comparative insights for context:

👥 Adoption: RIF is still in an “underdog” phase when it comes to user adoption. Its services (naming, storage, etc.) are growing but on a smaller base, largely within the Rootstock ecosystem. In contrast, some analogous projects on other chains have seen larger uptake. For example, Ethereum’s ENS (for naming) has become quite popular with hundreds of thousands of .eth names registered, and Filecoin (decentralized storage on its own network) boasts a massive storage network and a market cap in the billions. RIF’s current market cap (under $100M) is modest next to these. However, that also means RIF has more room to grow if it can capture even a slice of those markets on the Bitcoin side. It’s a classic high-risk, high-reward profile: smaller current adoption, but potentially big upside if adoption kicks into higher gear.

🛠️ Utility & Unique Value: Unlike many tokens that do just one thing, RIF’s one-token-multiple-services approach is fairly unique. On Ethereum, you’d need one token for storage, another for identity, another for oracles, etc. RIF bundles all that utility into a single token economy on Bitcoin. This could be an advantage: it simplifies the user experience and concentrates liquidity/value in one token. It’s somewhat comparable to infrastructure tokens like Chainlink (LINK) in the sense that its value comes from underpinning many applications, but Chainlink focuses purely on oracles whereas RIF covers a broader scope. RIF’s big unique value is being Bitcoin-centric. It leverages Bitcoin’s security (via RSK’s merge-mining) in a way that most other utility tokens don’t. For users and developers who believe in Bitcoin’s robustness but want more functionality, RIF offers a one-stop solution. That said, being tied to Bitcoin can be a double-edged sword: the Bitcoin crowd is sometimes slow to adopt new things (conservative by nature), so RIF has to prove itself and educate users that “Bitcoin DeFi” is even possible.

📈 Market Trends: When it comes to market trends, RIF has started to catch the wave of interest in Bitcoin layer-2 solutions. Earlier, projects like Stacks (STX) grabbed headlines as ways to do smart contracts or NFTs (like Bitcoin Ordinals) connected to Bitcoin. Stacks enjoyed a price surge when the narrative of “Bitcoin can do more than hodl” took off. RIF, by comparison, hasn’t yet had that big spotlight moment in the market cycle – but the ingredients are all there. If the trend of bringing DeFi and Web3 to Bitcoin continues, RIF could ride that thematic momentum. On the flip side, in the broader crypto market, utility tokens have had mixed fates: some soared in 2021’s bull run and then pulled back hard. RIF itself hit highs in 2021 and then dropped, similar to others. The difference now is that RIF’s ecosystem in 2025 is more mature than it was in 2021. So while many “concept only” tokens faded, RIF has been building in the bear market. For traders, this means RIF could be better positioned to capitalize on the next bullish turn, if it demonstrates real usage (which, as mentioned, seems to be gradually happening).

Bottom Line: Why RIF Deserves a Spot on Your Watchlist

RIF stands out by virtue of its close alliance with Bitcoin’s ethos and its all-in-one utility. Compared to similar tokens, it’s smaller and earlier in its journey – which carries higher risk but also higher potential reward. Gate.io users and utility-token watchers might see RIF as a diversification bet: it’s not just another Ethereum DeFi token, but a play on the Bitcoin side of decentralized tech. As always, competition is fierce, and RIF will need to keep innovating and growing its community to stay in the game.

The next few years will be telling – will RIF remain a niche player, or will it emerge as a go-to infrastructure for the Bitcoin-based crypto economy? 🚀 Only time will tell, but one thing’s for sure: the speculative excitement and the dedicated community we see on social media suggest that RIF will not be going quietly. Keep your eyes on this one – and of course, on those spicy Twitter threads for the latest alpha! 🔥

Disclaimer: This post is for informational purposes only – it’s not financial advice. Always DYOR (Do Your Own Research) and remember that crypto markets are volatile!

Share

Content